August 15, 2022 – The latest CPI report gave hope that rapid inflation might be starting to soften, but consumers’ purchasing power continues to be hindered by higher prices for goods and services across the board. That is doubly true in the housing market — only 16% of California households could afford to purchase the median-priced home according to C.A.R.’s Q2-2022 Housing Affordability Index. The average rate on the 30-year fixed-rate mortgage is nearly twice what it was at the start of this year despite having come down modestly in recent weeks. As a result, demand has fallen and supply is gradually rising, which is leading to a more balanced market for buyers and sellers.

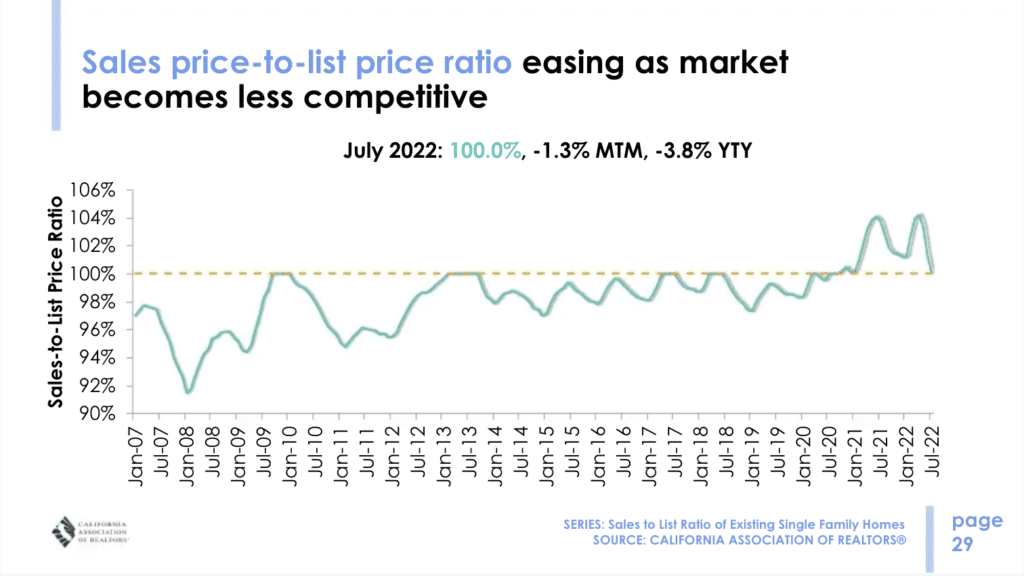

Market finding bottom or temporary blip?: After dropping precipitously in recent months, the first few weeks of August show that the market may be searching for a bottom on transactions. Through the first two weeks of the month, pending sales are actually up 1.9% from where they were last month. Although a modest increase, it is encouraging that pending sales have not fallen further in August. Recent trends in mortgage rates may have motivated some potential homeowners to take advantage of the fall from nearly 6% a few months ago to just 5.22% in the latest weekly data. The market continues to see competition ebb from red- hot levels with just 35% of homes closed last week selling over list price. That marks a steep deceleration from March, when 3 out of every 4 homes was selling for more than they were listed for on the MLS.

California housing affordability slides to the lowest in nearly 15 years in Q2-2022: As home price set a record high during the second quarter of this year, mortgage interest rates were also surging to nearly double of what they were the same time of last year. This combination has severely impacted housing affordability in California. Only 16% of California households could afford to purchase the $883,370 median-priced home in the second quarter of 2022, which dropped from 24% the previous quarter and from 23% the same quarter of last year. Household needed a minimum annual income of $199,200 in order to make the $4,980 including principal, interest and taxes on a 30-year fixed-rate mortgage at a 5.39% interest rate. Nationwide housing affordability also plunged in the second quarter of 2022.

Consumer confidence in the housing market improves slightly but remains subdued: The July 2022 California Housing Sentiment Index by California Association of REALTORS®(C.A.R.), revealed that buyers are beginning to see a light at the end of the tunnel by observing a tapering in both the price growth of homes and mortgage interest rates, as well as more inventory to choose from. However, sellers seem to be holding back a bit as they have grown more pessimistic that it is the right time to sell. The component of the index tracking consumers’ perspective on the ‘right time to sell’ slipped for the fourth consecutive month, to 60%, as indicators of market competitiveness show buyer demand has cooled-off from its highs due to affordability challenges.

Homebuilders’ confidence in worst slump since 2007 collapse: The National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index dropped 6 points in August to 49. This marks the eight straight decline in the index and the worst stretch since the housing market collapsed in 2007. Builder confidence is tumbling as high mortgage rates exacerbate affordability challenges, on top of elevated costs of materials and labor. The recent increase in housing inventory and a drop in home sales have led more homebuilders to be pessimistic about the outlook for future sales than those that remain optimistic.

July Consumer Price Index (CPI) foot off the gas: Inflation in July rose 8.5% from a year ago, but on a monthly basis, was flat as energy prices broadly declined 4.6% and gasoline fell 7.7%, according to the Bureau of Labor Statistics (BLS). That offset a 1.1% monthly gain in food prices and a 0.5% increase in shelter costs. Excluding volatile food and energy prices, the core CPI rose 5.9% annually and 0.3% from June. Consumers are still worse-off than they were last year when it comes to their purchasing power, but this is a positive sign that inflation may start to cool. However, inflation remains near the highest levels since the early 1980s, which means the Fed will continue to take an aggressive stance in their monetary policy for the foreseeable future.